Co-operative Bank of Kenya has announced the hiring of 1,104 new employees, marking a significant step in its aggressive expansion strategy across the country.

The move is set to bolster the bank’s operational capacity as it eyes underserved markets and gears up for increased digital and retail banking demand.

The new hires, which include customer service officers, relationship managers, IT specialists, and back-office support staff, come at a time when the bank is opening new branches and scaling its digital infrastructure to accommodate rapid growth.

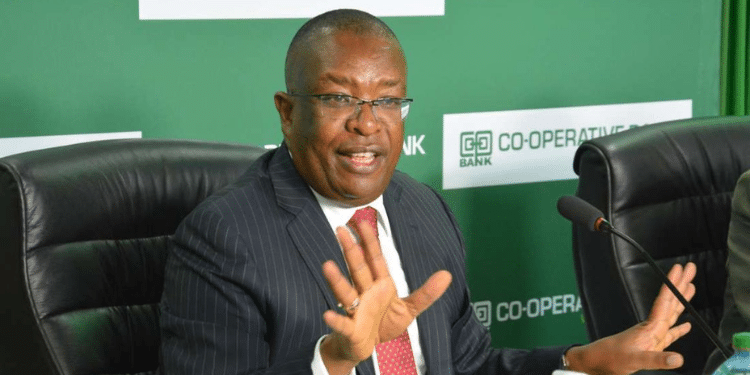

“We are investing in people because we believe our strength lies in the service we provide,” said Gideon Muriuki, Group Managing Director and CEO of Co-op Bank. “This recruitment is a testament to our continued confidence in the Kenyan economy and our commitment to financial inclusion across all regions.”

The hiring spree is part of a broader strategy that includes the opening of 15 new branches in counties that have traditionally been underserved by formal banking institutions. According to Muriuki, this expansion is aimed at enhancing access to banking services for small businesses, farmers, and SACCO members, in line with the bank’s cooperative roots.

“Our focus remains on supporting the grassroots economy,” Muriuki noted. “By hiring locally and expanding our footprint, we are creating jobs and bringing banking closer to the people. It’s not just about growth; it’s about impact.”

Industry analysts have praised the move, noting that Co-op Bank’s expansion could set a precedent for sustainable banking in a challenging economic climate. The bank has consistently maintained strong profitability and stability, backed by a solid customer base of over 9 million account holders.

In addition to physical expansion, the bank is investing heavily in digital channels to meet evolving customer needs. The new staff intake includes tech professionals to support its mobile banking platform, Co-op Bank App, and enhance cybersecurity.

Muriuki emphasized that the bank’s growth strategy balances digital innovation with human interaction. “While we continue to digitize, we also recognize that banking is a relationship business. Our people are at the core of the customer experience.”

The recruitment comes at a time when the Kenyan banking sector is showing signs of recovery after several years of subdued growth. Co-op Bank’s decision to expand both physically and digitally places it in a strong position to tap into emerging opportunities, especially in agriculture, SMEs, and cooperative societies.

The bank’s growth plans are expected to continue into 2026, with further investments in training, technology, and regional partnerships.

“This is just the beginning,” Muriuki concluded. “We are building a bank for the future—resilient, inclusive, and firmly rooted in the communities we serve.”